Debt Consolidation Singapore: Also Found Here for Total Monetary Relief

Debt Consolidation Singapore: Also Found Here for Total Monetary Relief

Blog Article

Why Carrying Out a Financial Obligation Administration Plan Is Necessary for Long-Term Financial Health And Wellness and Comfort

In today's complex economic landscape, the execution of a Financial debt Administration Plan (DMP) arises as an essential method for achieving long-term economic stability and assurance. By improving financial obligation obligations into a manageable style, individuals not only minimize the concerns of several creditors yet additionally grow vital budgeting skills. This positive technique lays the groundwork for monetary strength, yet several continue to be uninformed of the certain actions and advantages that come with a DMP. Recognizing these aspects can fundamentally change one's monetary trajectory, raising the question of exactly how one may start this necessary journey - also found here.

Recognizing Financial Debt Management Plans

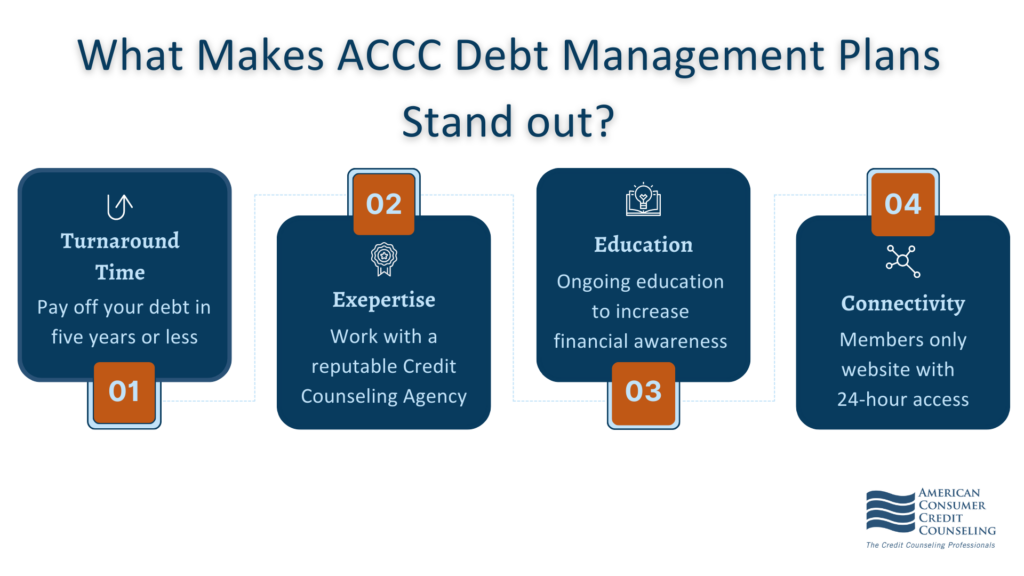

A considerable variety of people struggle with managing their debts, making Debt Administration Program (DMPs) an essential resource for monetary healing. A DMP is a structured settlement strategy that enables people to settle their financial debts right into a solitary regular monthly repayment, often at reduced interest rates. Generally assisted in by credit score therapy firms, these plans aim to streamline the financial debt settlement procedure and assistance individuals regain control over their economic scenarios.

The procedure begins with a complete analysis of the individual's economic circumstances, consisting of income, costs, and total financial obligation. Based upon this evaluation, a therapist creates a tailored DMP that details exactly how much the individual will pay each month and the expected period of the strategy. Lenders normally accept the proposed terms, which might include reduced passion rates or waived fees, making repayment more manageable.

Benefits of a DMP

While navigating the complexities of debt repayment can be difficult, a Financial obligation Administration Plan (DMP) provides numerous benefits that can dramatically reduce this worry. Among the key advantages of a DMP is the loan consolidation of numerous debts into a single monthly payment, simplifying economic management and minimizing the probability of missed settlements - also found here. This structured strategy can bring about lower rates of interest negotiated by credit score counseling companies, eventually minimizing the complete cost of debt in time

In addition, successfully finishing a DMP can positively influence one's credit report score, as consistent payments demonstrate economic responsibility. On the whole, the advantages of a DMP extend beyond mere financial debt reduction, fostering a sense of empowerment, financial security, and long-lasting satisfaction for those dedicated to improving their economic wellness.

Actions to Execute a DMP

Applying a Debt Monitoring Strategy (DMP) includes several key actions that make certain a smooth change into an organized settlement process. The very first step is to analyze your monetary situation by gathering information on you could check here all debts, earnings, and expenses. This extensive view permits for better planning.

Following, it's advisable to seek aid from a credible credit counseling firm. These professionals can aid you comprehend your choices and guide you in producing a tailored DMP that matches your economic needs. They will certainly discuss with your creditors to reduced passion rates and develop a workable repayment timetable. when you've picked a firm.

After reaching a contract, you will certainly make a solitary monthly payment to the agency, which will certainly then disperse the funds to your creditors. It's necessary to devote to this layaway plan and avoid building up extra financial debt throughout the settlement period.

Overcoming Common Difficulties

Browsing a Debt Management Plan (DMP) can present different obstacles that may hinder progress. Among one of the most usual barriers is the psychological pressure associated with managing financial debt. The anxiousness and stress can lead some people to abandon their strategies prematurely. To counter this, it's vital to cultivate an assistance system, whether with friends, family members, or specialist counseling, to preserve inspiration and accountability.

Additionally, some people might deal with the self-control needed to abide by a strict budget. Creating a sensible budget that accounts for both vital costs and optional spending can aid preserve conformity with the DMP. Regularly changing the budget and assessing as needed is additionally important.

Lastly, there may be a lure to incur new financial obligation, which can drastically undermine progress - also found here. Developing clear financial objectives and recognizing the long-lasting benefits of the DMP can aid keep emphasis and discourage impulsive costs

Long-Term Financial Strategies

Efficiently managing a Financial debt Management Strategy (DMP) not just entails getting rid of click for source instant challenges however also needs a forward-looking strategy to monetary wellness. Long-term monetary methods are necessary to ensure that individuals not only alleviate their existing financial obligation however also build a secure foundation for future monetary health.

Among one of the most critical methods is budgeting. Developing a comprehensive monthly budget plan allows individuals to track income and expenditures, guaranteeing that they allocate enough funds in the direction of financial obligation payment while additionally alloting cash for investments and cost savings. Additionally, establishing a reserve can provide a financial buffer versus unpredicted expenditures, reducing the likelihood of sustaining brand-new financial debt.

Buying monetary education and learning is an additional important element. Understanding the characteristics of debt, rates of interest, and financial investment options encourages people to make enlightened choices. Additionally, establishing clear economic goals-- such as conserving for retired life or buying a home-- can offer motivation and direction.

Final Thought

In conclusion, carrying out a Financial debt Management Plan is critical for fostering lasting monetary health and achieving satisfaction. By simplifying financial obligation payment, urging self-displined budgeting, and promoting financial education and learning, a DMP equips people to reclaim control over their funds. The consolidation of different financial obligations into a single settlement reduces tension and lowers the threat of missed settlements. Ultimately, the fostering of a DMP lays the structure for a more safe and flourishing monetary future.

In today's intricate economic landscape, the execution of a Financial obligation Administration Strategy (DMP) arises as a critical technique for attaining lasting economic security and peace of mind.A substantial number of individuals struggle with managing their financial debts, making Debt Management Plans (DMPs) an important resource find here for financial recovery.While navigating the complexities of debt settlement can be difficult, a Financial obligation Administration Plan (DMP) offers various benefits that can substantially alleviate this problem. One of the key benefits of a DMP is the consolidation of multiple financial debts into a single regular monthly settlement, streamlining monetary management and decreasing the possibility of missed payments. By streamlining financial debt settlement, motivating regimented budgeting, and promoting economic education and learning, a DMP encourages people to gain back control over their funds.

Report this page